Doctor mortgage loans, aka physician mortgage loans, are being offered by an increasing number of banks and to an increasing number of high-income professionals other than just doctors. On this page, you’ll find what you need to know about physician mortgage loans, weigh the pros and cons, and determine if a doctor loan is right for you. We'll also discuss other financing options for purchasing a home—including conventional loans, FHA, and VA—and introduce you to the best lenders offering these programs to white coat investors.

For conventional home loans or refinancing, check out our conventional mortgage page.

Each WCI Recommended Mortgage Lender can be found by clicking on the map or the list found in the “See All Lenders” link below. They are the best in the business vetted by our staff and thousands of white coat investors over the years. Each of these only offers physician mortgage loans in certain states. These lenders are paid advertisers on the blog and will give you the top-notch service you've come to expect from a company recommended by WCI. If you find the service anything other than excellent, please let us know. Thank you for supporting those who support The White Coat Investor.

A physician or “doctor” mortgage is a special loan program a lender puts in place to attract high-income clients by allowing health care professionals such as doctors and dentists to secure a mortgage with fewer restrictions than a conventional mortgage.

Common restrictions doctors run into are

Amazingly, some doctors think banks should lend them money just for being doctors. Well, you don't get a pass on math, but there are quite a few institutions that recognize that the financial lives of doctors are a little bit unique, that they aren't as bad a credit risk as their high debt-to-income ratio would suggest, and that they can bring other valuable business to the bank.

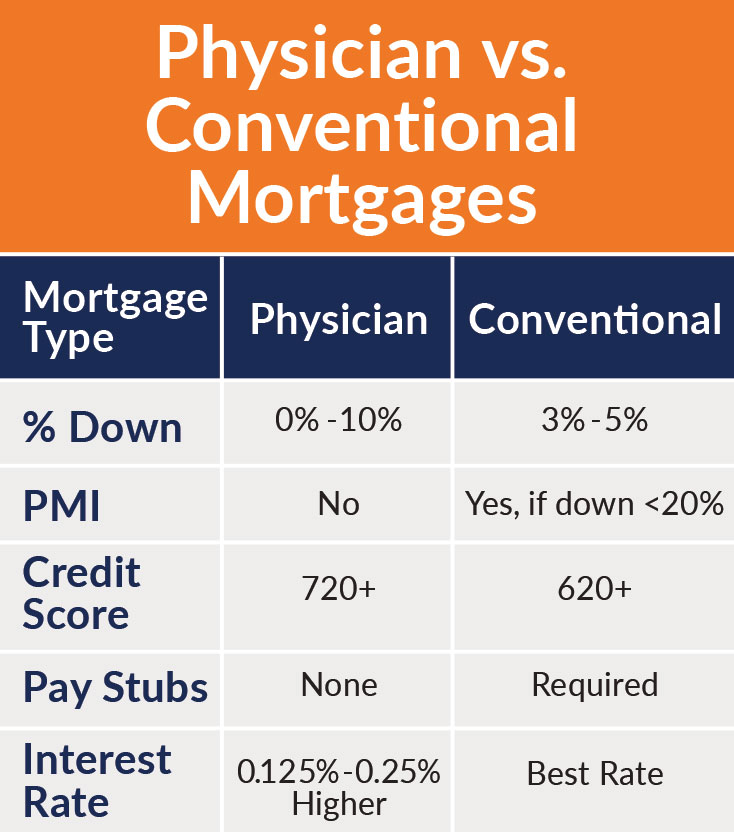

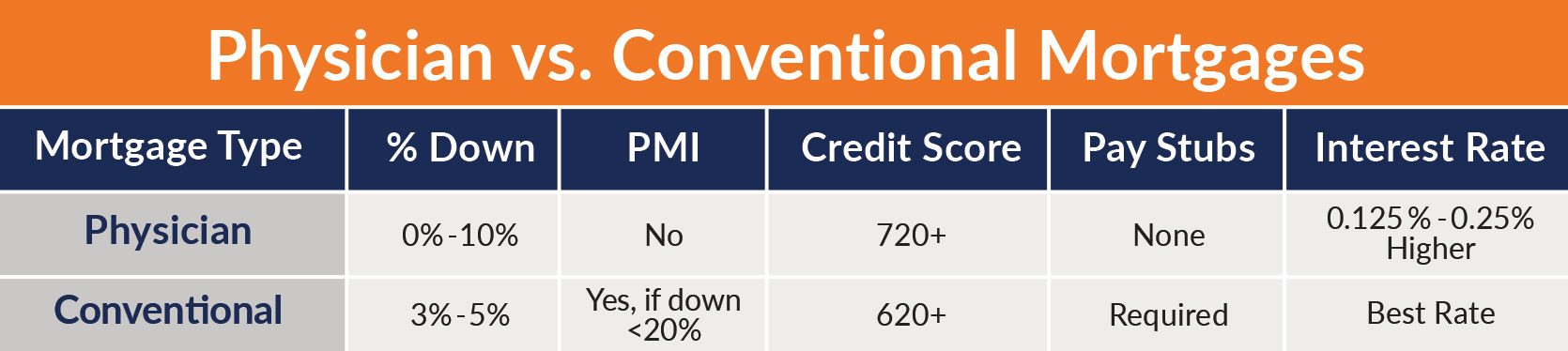

Physician mortgages work similarly to conventional mortgages but are much more accommodating to physicians and their unique circumstances.

The main point is that a doctor can put down less than 20% and still avoid paying Private Mortgage Insurance (PMI). PMI is insurance that you pay for to protect the lender against you defaulting.

Physician mortgages also generally only look at the total required student loan payment, not the total amount owed, and will generally accept a signed employment contract as proof of income, rather than requiring tax stubs. Independent contractors often still need two years of tax returns to prove income.

Due to the lower down payment requirement and waived PMI there is typically a price to be paid to use a doctor loan. That price can come in the form of a higher interest rate (0.125% to 0.25% higher than a conventional mortgage) or in higher fees. However, it pays to shop around. Some doctors have found excellent rates and fees that are comparable to a conventional loan. Remember that mortgage rates change daily. Also, there's more than just the rate to compare—don't forget to take into account fees and points.

The general rule is as many times as you want, although every bank has its own unique program with its own unique rules. Some will no longer extend physician loans to a doctor once they are more than 10 years out from school or residency. It is even possible to have more than one physician loan at a time as you move from house to house, but they are typically only offered on owner-occupied homes, not investment property.

Always read the paperwork carefully when signing for a loan, but most mortgages, including doctor mortgages, have no early repayment penalty. That means you can refinance them at any time. With a physician mortgage, it can make sense to refinance into a lower rate conventional mortgage after a few years because generally

Most doctors (physicians and dentists) realize that these loans are designed for them. But many other professionals may not realize they also qualify.

While appropriately named to target doctors, Physician Mortgage Loans are also available to other high-income professionals such as:

Student loans that are in Income Dependent Repayment (IDR) programs (such as IBR or PAYE) get special treatment under physician mortgage loan programs.

Josh Mettle of Neo Home Loans explains:

“The mortgage underwriter will allow the lower income-driven repayment, as opposed to defaulting to a fully amortizing payment (as in a conventional loan). Also excluded is any student loan that is deferred for at least 12 months from the date of closing.”

You'll need to maintain good credit in the 720-740 FICO score range to obtain a physician loan. However, under certain conditions, some of our recommended mortgage lenders will lend down to a 680 credit score if you have 6-12 months of cash reserves.

Frankly, if you have a credit score below 720, you probably aren't ready to be buying a house anyway. Pay off your credit cards (but don't necessarily close them as they can lower your score), don't miss any payments, and don't borrow any more money and you should have a score over 720 soon. It's not the end of the world to rent for a year (and it is often a very good idea if going to a new area or a new job anyway) and that is long enough to clean up your credit most of the time.

We are not necessarily against doctor mortgages, but we think most people ought to at least consider saving up a real down payment and delaying that purchase, especially if you're looking at getting that dream house right out of residency (or worse, buying a house during a short residency).

So why would someone want to use these loans? Usually, it's because they are in a rush to buy a house. But after deferring gratification for 10-15 years, many of us have a much better use for our money than a down payment, such as maxing out retirement accounts or paying off student loans.

The main advantages of physician mortgage loans are:

Some disadvantages of using a physician mortgage loan:

Utilizing a Doctor Mortgage for an investment property is an unacceptable level of risk. The best way to ensure your investment property will have positive cash flow is to put down 25%-35% in cash. And if you're going to do that, you don't need a physician mortgage. Perhaps there are some special circumstances where it can work out such as when you house hack by buying a duplex, live in one side and rent out the other or perhaps you just found an incredible steal of a deal on a property that will cash flow despite a tiny down payment. You will still need to live in the property at least for a year or two before turning it into an investment property.

There is a lot that goes into this question, but most residents and fellows should rent instead of buy for several reasons.

If you've decided to buy a home, and you are committed to living in an area for more than five years, you should give serious consideration to putting 20% down and getting a conventional mortgage. The improved monthly cash flow will allow you a great deal of financial freedom and the ability to invest (and even spend). You'll save hundreds of thousands on interest over the life of the loan, all guaranteed, unlike investing a potential down payment elsewhere. But if, for whatever reason, you're going to buy a home AND you can't or don't want to put 20% down, then a doctor's loan is a reasonable option and at least as good as the other non-20%-down options.

If you don't believe a traditional physician mortgage loan is right for you, you may be wondering what other options a doctor may have? It turns out plenty, and you can usually get most of these options from the same lenders who do physician mortgage loans.

Conventional mortgages are loans that are not guaranteed by the Federal government. They are often the best choice for a mortgage as they generally offer the most options (30-year fixed, 15-year fixed, ARMs, etc.), the lowest fees, and the lowest rates. However, conventional mortgages require proof of earnings and a substantial sum of money to put down. That money, of course, becomes unavailable to invest or pay down student loans.

These disappeared from the scene after the 2008 Global Financial Crisis, but have been making more of a resurgence since. The theory is that you would get an 80% loan at a slightly higher rate than on a 20% down loan, then get a 20% loan at a much higher rate. You would avoid PMI replacing it instead with more interest. The 80/10/10 and 80/15/5 were variations on the theme, with a down payment required.

These loans have higher rates and fees than a 20% down mortgage. They also require you to purchase PMI. 3%-5% down payments are common.

FHA Loans are used by those with credit scores as low as 550 and/or those with down payments as low as 3.5%. This loan has higher rates and fees than a 20% down conventional loan—most notably, a 1.75% Upfront Mortgage Insurance Premium (UMIP) financed on top of the principal loan amount. In Addition to the UMIP, you'll also pay a required monthly Mortgage Insurance Premium (MIP) (0.8%-0.85% of the loan balance annually) for the life of the loan.

The FHA requires the lender to use the credit report amount of the student loan payment, or if none listed, 1% of the outstanding balance unless the borrower can provide documentation that the loan is in deferral. This makes this loan tricky for indebted residents to qualify for. The rates are generally, however, slightly lower than a doctor loan, but may not be when you add in the mortgage insurance costs.

This loan requires that you qualify for VA benefits, which disqualifies many. It is an improvement on the FHA loan in that there is no down payment nor mortgage insurance requirement. Rates are similar to FHA rates, but the funding fee is higher—2.15% for first-time borrowers and 3.3% for subsequent use. That fee may be waived if you have a military disability rating.

You will find that banks will generally loan you more money than you should really borrow. They use guidelines like the 28% and the 36% rule. Basically, they'll loan you money until the mortgage payment is no more than 28% of your pre-tax income and your total debt payments cannot use up more than 36% of your pre-tax income. However, that's really an insane amount of mortgage debt for a doctor to take on. If you do that, you will almost surely have severe difficulty building wealth.

Run the numbers to see. Imagine a doctor with a $400,000 annual pre-tax income. 28% of $400,000 is $112,000, or $9,333 per month. How much house does that buy and how big is that mortgage? Let's assume this doctor put 10% down and gets a 30-year fixed mortgage at 3.5%. That's basically a $2 million mortgage on a $2.2 million house. That's a 5x debt-to-income ratio. Do not do that.

We have two rules of thumb for doctors who actually wish to build wealth. The first is to keep all housing-related costs to less than 20% of gross income. That includes the mortgage, property taxes, insurance, and utilities. The second rule is much easier to use: keep your mortgage to less than 2x your gross income. It's even better at 1x. Using that rule of thumb, our doctor making $400,000 could have a mortgage of up to $800,000. With a 20% down payment, that would equal a $1 million house. Want more house? Save up a bigger down payment or figure out a way to make more money.

In high cost of living areas such as the Bay Area, Manhattan, and the District of Columbia, sometimes a doctor has to stretch this rule a bit. If you are in that situation, realize two things. First, stretching means going to 3x-4x gross income, NOT 10x gross income. Second, you will need to make up for this stretch somewhere else in your financial life. That might mean:

There's no free lunch. You don't get a pass on math just because you live in San Jose.

When you run the numbers, you can easily see you'll be better off borrowing as much money as possible and investing it at a higher interest rate. This is the benefit of leverage. Consider a hypothetical $500,000 home. You could save $235,000 using a 20% down conventional loan over the doctor's loan. But if you invested that $100,000 down payment at 8% over 30 years, you'd end up with over $1 million. The terms of this “margin investing” are favorable, in that you have a lot of time for the market to rebound and there are no margin calls on mortgages. Unfortunately, there are a few reasons why you probably don't want to do this:

If you are in need of a realtor the White Coat Investor partners with CurbsideRealEstate.com, a free real estate concierge service for physicians, by physicians. After struggling through his first home purchase, Dr. Peter Kim founded Curbside Real Estate to address physician-specific issues encountered during the home buying process. In addition to providing news and information, CurbsideRealEstate.com is your physician-led “curbside consult” for physician mortgage loans, expert real estate agents, relocation, and everything in between. Whether you’re securing your first physician home loan, just beginning your home search, or you're not sure where to start, CurbsideRealEstate.com can help you navigate the home buying process confidently and efficiently, saving you valuable time and money.

Exclusive bonus for White Coat Investor readers: $100 bonus at closing.

Contact CurbsideRealEstate.com at [email protected] or at 323-515-9507 for a no-commitment consultation and follow them on Facebook, Twitter, and Instagram for more information.